In 2008 a game went over the financial world: "blame anonymous men at market participants, methodology and technology providers, ... for the crisis".

I will concentrate on quant finance and issues that are in the frame of the business we are in: models and methods for derivative and risk analytics.

Forget "Strategic Alignment" in Complexity Economy

Strategic alignment (of business processes)? Whatever the business purpose is - align your organization to deliver on that purpose (but this definition is far from settled). However, it usually leads to a one-size-fits-all approach for an organization from human resources to information technologies.

Blast Furnaces and Mathematical Finance

Iron is produced from iron ore, coke and additional materials (magnesite, dolomite, .. to decrease the melting pot, control viscosity ...). Among the processes of iron production, the blast furnace process is still the most prominent one.

A modern blast furnace produces up to 5 mio tons of iron / year and ca be operated continuously for up to 10 yeas before shutdown.

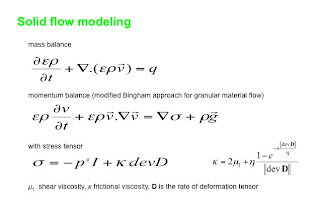

To control the process you need to model various phenomena, like flows of iron ore and coke, liquid due to melting, gas - from bottom to top, energy - heat conduction and convection, mass and chemical reactions.

As the iron ore sinks it is indirectly reduced: Fe2O3 --> Fe3O4 --> FeO --> Fe.

The typical sitze of the problem: 40.000 spatial unknowns per scalar component of 20-30 unknown functions (temperature, max concentrations, velocities).

Computing time on a PC: about 4 hours for a real-time day. Not bad for faster-time-to-insight and decisions.

Again, what has this to do with computational finance?

The equations are similar (convection-reaction-diffusion) and consequently we have transferred the optimized PDE and Fourier based solvers to finance and organize them orthogonally to instruments and models - enabling model validation ...

Our numerical repertoire for valuations embraces Adaptive Integration (a asymptotic math method), Finite Elements with Streamline Diffusion, Fourier-based methods (linking with cos methods), all transferred from complex technical systems, and tuned and modified Monte Carlo schemes (including least square and Longstaff Schwartz).

Embedded in a center focussing on inverse problems research, our calibration engines are blazingly fast and robust.

Stable and robust cross-sectoral mathematics really matters.

A modern blast furnace produces up to 5 mio tons of iron / year and ca be operated continuously for up to 10 yeas before shutdown.

To control the process you need to model various phenomena, like flows of iron ore and coke, liquid due to melting, gas - from bottom to top, energy - heat conduction and convection, mass and chemical reactions.

As the iron ore sinks it is indirectly reduced: Fe2O3 --> Fe3O4 --> FeO --> Fe.

The typical sitze of the problem: 40.000 spatial unknowns per scalar component of 20-30 unknown functions (temperature, max concentrations, velocities).

Computing time on a PC: about 4 hours for a real-time day. Not bad for faster-time-to-insight and decisions.

Again, what has this to do with computational finance?

The equations are similar (convection-reaction-diffusion) and consequently we have transferred the optimized PDE and Fourier based solvers to finance and organize them orthogonally to instruments and models - enabling model validation ...

Our numerical repertoire for valuations embraces Adaptive Integration (a asymptotic math method), Finite Elements with Streamline Diffusion, Fourier-based methods (linking with cos methods), all transferred from complex technical systems, and tuned and modified Monte Carlo schemes (including least square and Longstaff Schwartz).

Embedded in a center focussing on inverse problems research, our calibration engines are blazingly fast and robust.

Stable and robust cross-sectoral mathematics really matters.

Big System for the Small

Arming David - in a market of Goliath able to justify huge spend on risk management how are the numerous asset management teams in small financial institutions to meet regulatory pressure whilst remaining cost effective.

Up to 11 - the Micro-Multinational

The industrial revolution gave us mass production and factories. They became continuously automated and flexible. Flexible automation in software seems to be much easier, but it becomes more complex when operating massive data and crunching tons of numbers - together.

The Lightsabers of Quant Finance

74 Things Every Great Star Wars Movie Needs from Wired Underwire. #22 Lightsabers - they are light, precise, focussed (cutting like a scalpel ...), easy to pull, .... not a weapon destroying masses, great in the hand of the good - to fight, say, hidden monsters under surfaces.

The Pain of Paying

Recently I read this in Dan Ariely's Blog. We are not in mass production and consequently this is not so relevant for us.

No, UnRisk is Not for "You"

You know the situation of a post concert, film, novel reading .... discussion with a group of participants in the near cafe ... everybody critical in some details but really pleased with the event in general ... but one speaking with a sharp tongue: no, this was not compatible with what I find good?

Investment and Risk Manager Adjustment

Statistically speaking, they are all the same - but we are not about statistics.

Investment managers work for the benefit of investors to meet specific investment goals and risk management is an indispensable part of the decision making process.

Investment managers work for the benefit of investors to meet specific investment goals and risk management is an indispensable part of the decision making process.

Subscribe to:

Posts (Atom)